25% of the fintech market is gripped by one fintech product- digital payments.

But that is not why Venmo founders Andrew Kortina and Iqram Magdon-Ismail established a fintech app.

The story goes that friends from the same Alma Mater, Iqram visited Andrew in New York but forgot his wallet back home. Andrew paid for him throughout the visit.

To pay his friend back, there was no solution at the time.

This is where the idea for a peer-to-peer digital payment app, Venmo, was born and established in 2009.

But the question beckons,

What is Venmo's business and revenue model?

Down the line, it began integrating a community platform which attracted users and person-to-business transactions which generated revenue.

Today, it is one of the top fintech apps in the US.

What does Venmo do?

Did you know that Venmo started out as an SMS-based money transfer app?

That was the initial MVP stage. Today, Venmo also hosts a popular social networking feature alongside the money transfer aspect.

How does the whole thing work?

- Add your credit card, debit card, or bank account within the app.

- Verify your account in any of the two ways:

- Transfer funds as and when you want

- You are eligible to use the community feature as well.

- Verify through online banking and password

- Verify the withdrawal amount number made by Venmo

- Venmo to bank and back

- Venmo to Venmo

- Add Venmo alongside PayPal

Venom started as an independent venture but was soon acquired by Braintree, which was acquired by Paypal in 2015 for $800 million.

Since this development, the integration of Venmo in Paypal transactions has also increased its popularity.

Venmo Business model

Over 70 million people use Venmo. So much so that it accounted for 19% of third-party verifications in Paypal.

There are two kinds of profiles in Venmo’s business model.

Personal Profile: for individual transactions like splitting bills, paying at stores, and a ‘trust’ feature for recurring payments.

Business Profile: for accepting business payments, bookkeeping, and analytical insights from customers.

You can also switch between two profiles based on your needs. Both these cases allow you to take advantage of its social features.

Venmo Revenue Model

Venmo makes its profit through various transactional features whereas peer-to-peer transactions are free:

Pay with Venmo

Merchants get charged for every order and transaction.

Venmo transactions can be viewed in their community if a user has permitted the feature. This is a great marketing base for merchants.

- Users who pay through Venmo to a merchant get a small fee added to their order payments.

- The merchant end is charged 1.9% of the order.

- Plus, $0.10 per transaction for merchants

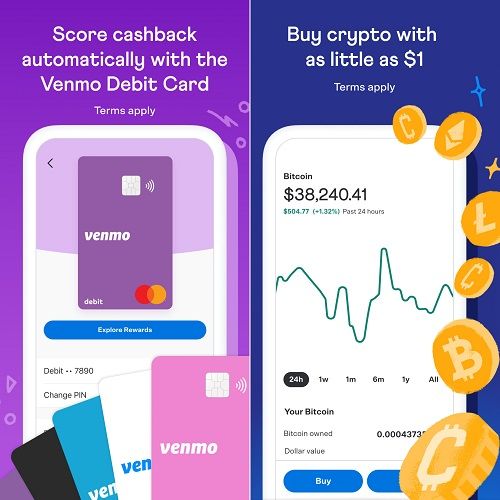

Credit and Debit Cards

Are you a Venmo account holder?

Great!

You are eligible for a credit card and debit card.

- 3% charge for credit card usage.

- You can also pay using the Venmo balance

- $2.50 fee for ATM Withdrawal and $3 for Counter Withdrawals.

- Overdue charges: 11.99% to 20.99% annually.

Instant Transfers

Venmo to bank transfers take 1 to 3 business days.

You can do an instant transfer, but there is a small charge.

- The charges before April 2022: 1.5% for instant transfers, $15 maximum.

- Current charges: 1.75% charges, $25 maximum.

Crypto Fees

Since June 2021, Venmo has also been making money by opening up their app for users to crypto trade.

- Buy crypto currency for as low as $1.

- It currently includes: Bitcoin Cash, Bitcoin, Litecoin, and Ethereum.

Cash a Check

You must have a verified email address to qualify for a check deposit.

Then,

You enable the ‘Credit Deposit’ feature.

Having a Venmo Credit Card also works as an alternative.

- Take a picture of the check to allow Venmo to retrieve it.

- Venmo can also deposit it into your bank account if permitted.

- The verification charge is 1%

- Charges for Non-payroll and non-government checks are 5%.

That’s not all!

You get other value-added services like Cashbacks on partner stores like PapaJohns, Target and more.

Venmo earns profit through some other methods not included in the above list:

- Merchant Credit products

- Gateway fees

- Referral fees%

- Subscription fees

- Brand partnerships

From 2009 to 2022, Venmo has changed a lot.

Certainly, Paypal played a significant role.

Features like Crypto trades and unique features like Cash-A-Check in 2021 have piqued people’s interest.

Evaluation and Revenue Status

Did you know Venmo’s first funding came from co-founder Kortina’s former employer?

Venmo went through 3 rounds of funding, raising $1.3 million in total.

During its first acquisition by Braintree, it was valued at $26.2 million. Then came Paypal, and you know the rest.

Conclusion

Venmo’s business model revolves around peer transactions.

In 2021, $200 million worth of payments were made through Venmo

That’s 20% of PayPal’s transactions!

All the additional services, from crypto trading and check deposits to brand partnerships, are where Venmo earns money.

No wonder PayPal has big plans for Venmo. The projected revenue for 2023 is $2.4 billion.

You can expect great new things with Venmo’s app in the future.