In the quiet chambers of our grandparents' homes, tales are told of a time when banking required long queues, bulky ledgers, and impeccable trust in the man behind the counter.

Today, while sipping coffee, one can transfer money, check balances, or even take out a loan with just a few taps on a smartphone. And yet, as we bask in the convenience of digital banking, a new chapter in the world of finance is being written - that of blockchain. It's a realm where traditional financial pathways merge with the promise of decentralized, secure, and transparent transactions.

We will explore how this innovative ledger technology fits into the tapestry of our existing banking systems. And more importantly, how will it redefine the contours of future financial landscapes?

What Can Blockchain do for Traditional Banking?

Blockchain, often known as the backbone of cryptocurrencies, has a lot to offer traditional banking too.

At its core, blockchain is a secure, transparent, and decentralized way of recording transactions. For banks, this means several things.

Firstly, it can significantly cut down the time and costs involved in cross-border transactions, as the need for intermediaries gets reduced.

Secondly, the transparent nature of blockchain can boost trust and security, making fraud detection easier.

Moreover, smart contracts can help make typical banking activities more efficient and less complicated.

In essence, by adopting blockchain, traditional banks can offer faster, safer, and more cost-effective services to their customers.

- Streamlining KYC (Know Your Customer) Processes

Traditional banks typically have extensive and time-consuming processes for customer due diligence and Know Your Customer (KYC) requirements. Blockchain in the banking industry can simplify and automate this process by providing a secure and immutable record of customer identity and transaction history. This enables banks to easily verify customer information, reduce duplication of effort, improve compliance, and expedite customer onboarding procedures. - Improving Security in Payments

With blockchain, banks can significantly enhance payment security. By leveraging the decentralized nature of blockchain, transactions can be securely recorded and verified, reducing the risk of fraud and hacking. Blockchain-based smart contracts can also enable automatic execution and settlement of payments, ensuring timely and secure transactions. - Enhancing Cross-Border Payments

Cross-border payments often involve multiple intermediaries, lengthy settlement times, and high fees. Blockchain industry and blockchain technology can streamline this process by enabling direct peer-to-peer transactions without the need for intermediaries.

Using blockchain, banks can facilitate faster, cheaper, and more transparent cross-border payments, benefiting both businesses and individuals. - Facilitating Trade Finance

Trade finance involves complex transactions, documentation, and multiple parties. Blockchain can simplify and digitize the entire trade finance process by enabling the secure and transparent recording of trade-related documents, such as bills of lading and letters of credit, on a blockchain. This eliminates the need for manual document verification, reduces the risk of fraud, and improves the efficiency of trade finance operations. - Enabling Tokenization of Assets

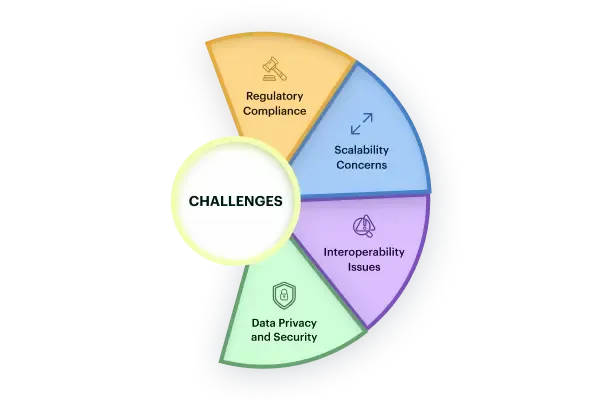

Blockchain technology can enable the tokenization of traditional assets, such as real estate, stocks, and bonds. By representing these assets as digital tokens on a blockchain, banks can unlock liquidity, increase accessibility to investment opportunities, and reduce the complexity and costs involved in asset transfers. Tokenization has the potential to democratize access to investment and open up new possibilities in traditional banking. - Regulatory Compliance: Incorporating blockchain means navigating complex regulations, such as AML, KYC, and data protection standards. Especially for global transactions, adherence to these frameworks is paramount to avoid legal complications.

- Scalability Concerns: Blockchain networks can face bottlenecks as transaction volumes surge. For effective integration into banking, these networks must continuously evolve to support high transaction rates akin to established banking systems.

- Interoperability Issues: Banks often need to communicate across varied financial systems and blockchain platforms. Without standardized protocols, ensuring these diverse systems work cohesively becomes a significant challenge.

- Data Privacy and Security: While blockchain's decentralized nature offers enhanced security, safeguarding customer data remains paramount. This entails advanced encryption methods and controlled access to maintain the confidentiality of user information.

In summary, blockchain technology offers numerous opportunities for traditional banking systems to enhance security, streamline processes, and drive innovation. Big banks like Bank of America and JP Morgan also started to adopt blockchain. We can expect to see significant transformations in the way traditional banking operates, bringing benefits to both financial institutions and their customers.

How to Bridge the Gap?

Bridging the gap between traditional banking and digital finance requires a fusion of the old and the new. Banks should invest in digital infrastructure, ensuring they adopt the latest in fintech solutions, from mobile banking apps to blockchain technologies. Collaborations with fintech startups can spur innovation and infuse the traditional system with agile and customer-centric solutions.

Financial literacy campaigns can educate customers, especially the older generation, about the benefits and safety of digital tools, helping them transition smoothly.

Regulatory frameworks also play a crucial role; they should evolve to support both worlds, ensuring protection for consumers while not stifling innovation.

By integrating the stability of traditional banking with the agility and innovation of digital finance, a seamless financial ecosystem can be created that serves the needs of all.

Challenges and Risks of Implementing Blockchain in Banking Industry

While blockchain technology offers numerous benefits to the banking industry, there are also various challenges and risks that institutions need to consider when implementing blockchain solutions. Here are some key challenges and risks:

The Future of Blockchain in the Banking Industry: Numbers and Novelty for Startups

Diving deep into blockchain's potential for banking isn't just about visions—it's about validated numbers and trends. Here are some insights enhanced with key statistics:

Decentralized Finance (DeFi): As of 2022, the total value locked in DeFi platforms exceeded $48 billion, with Ethereum dominating over half of the market. It signifies a massive shift from traditional financial systems to decentralized ones. Startups can exploit this trend, offering innovative DeFi solutions to bridge gaps in traditional banking.

Banking-as-a-Service (BaaS): Research indicates that the global BaaS market is expected to grow to $24.94 billion by 2027, with a CAGR of 39.5%. It means startups can develop platforms where established banks integrate blockchain services, Uniting trust with transformation.

Sustainable Banking: Sustainable investments reached over $35 trillion globally in 2020. Blockchain's ability to track and authenticate green investments could appeal to a rapidly growing demographic concerned about the planet's future.

Conclusion

The merging of blockchain with traditional banking is more than a technological advance; it's a paradigm shift in finance. Offering transparency, efficiency, and a democratized approach, blockchain has the potential to redefine banking norms. Yet, this transition is not without its complexities, from scalability hurdles to regulatory intricacies. As we navigate this new frontier, it's essential for institutions to harness the essence of both worlds—preserving the trust of traditional banking while embracing the innovation of digital finance—to craft a truly inclusive and transformative financial future.

Frequently Asked Questions on Blockchain and Banking Industry

Ques 1: What blockchain are banks using?

Ans: Banks commonly use blockchain platforms like Ethereum for smart contracts, Ripple (XRP) for international transfers, and Hyperledger for private business networks, tailoring their choice to specific needs like transaction speed, privacy, and application type.

Ques 2: How banks can use blockchain technology?

Ans: Banks use blockchain technology to streamline and secure financial processes like cross-border payments, trade finance, and fraud prevention, as well as for efficient identity verification and loan processing. This technology enhances efficiency, security, and transparency in banking operations.

Ques 3: Will blockchain disrupt banking?

Ans: Yes, blockchain is poised to disrupt banking by offering more secure, efficient, and transparent financial processes, reducing costs and time for transactions, and enhancing fraud detection. However, its full integration faces challenges like regulatory compliance and scalability.